Are you an owner-director with an overdrawn director’s loan account? Watch our 2-minute primer to help you understand the tax implications and how to deal with them.

It is entirely reasonable for business owners to assume that any money in their company’s bank account is theirs. However, there are significant tax consequences how the funds are extracted. This is why the (often misunderstood) Director’s Loan Account (DLA) is so important. It is an account that records the transactions between the company and the director.

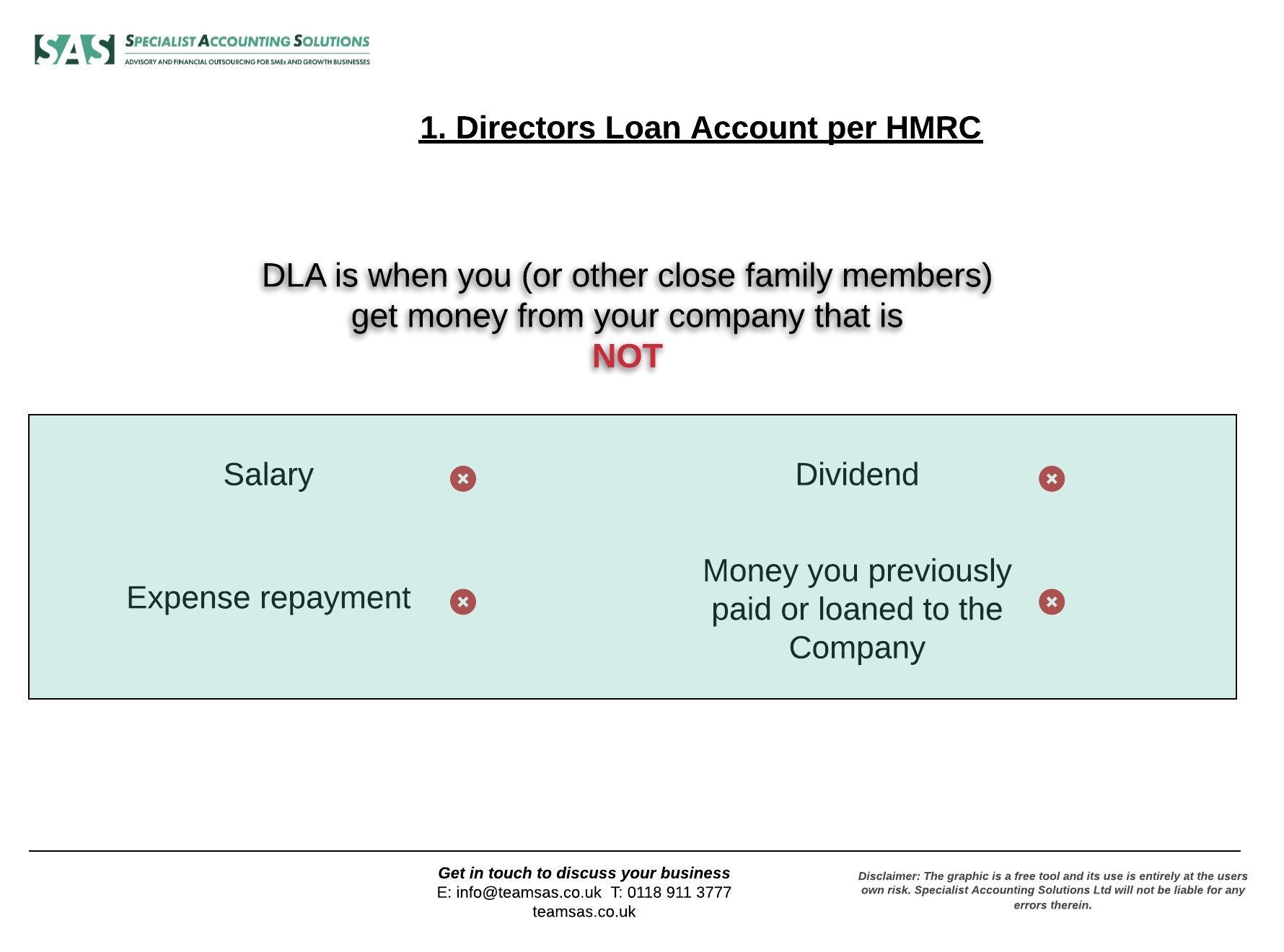

HMRC says a DLA is when you, or close family members get money from your company, that is not a salary, dividend, an expense repayment or money previously loaned to the company.

Quite often the DLA is overdrawn at the end of the financial year. This means that the director “owes” money back to the company. If the amount borrowed is not paid back within 9 months and 1 day from the end of the financial year, then the company is liable for an additional tax charge. The tax charge is under section 455 CTA 2010 at rate of 32.5%.

For example, if the DLA was overdrawn by £8,000 and not repaid, the company under s455 would have to pay a tax charge £2,600 (32.5% x £8,000).

How does the company legally avoid paying this tax?

The simplest solution is to make a cash repayment back to the company.

If the company has sufficient distributable profits and the director is also a shareholder, then the company can declare a dividend. No cash changes hands, as this dividend offsets the cash already taken. Furthermore, dividends must be paid proportionally to shareholdings.

If there aren’t enough distributable reserves, then you can either allocate unpaid salaries as a credit to the DLA, or declare a bonus. Using a bonus offers more timing flexibility as it is tax deductible for the company in the financial year it relates to, not when the payment is made.

For further information on Director’s Loans go to the HMRC website.

For more business insight on subjects including fundraising, debt, equity and more go to our resource section.

If you would like to discuss how we can support your business with our outsource accounting services and virtual CFO services, please get in touch. We look forward to hearing from you.

Use of this information is for reference only. Specialist Accounting Solutions Ltd accepts no liability for any errors therein or any losses or damages arising from it.

Understand the tax implications of a Director’s Loan Account